News

F17-b4 Petroleum License Extension

January 5, 2026

On December 9, 2025 the F17-b4 exploration licence was approved to be extended for two years (until January 26, 2028) by the Turkish petroleum regulator. Performance bonds were put in place on January 2, 2026, securing the extension.

Coiled-Tubing Operation

October 27, 2025

Gazelle Energy Limited is pleased to advise that a 10-day workover operation of the Pehlivanköy-2 well was completed in late August 2025. Coiled-tubing was used to lift the well with nitrogen, allowing flow rates to be measured from each of the primary Teslimköy-1 and Teslimköy-2 reservoirs that were hydraulically stimulated in May 2025. Flow rates achieved from Teslimköy-1 exceeded 375 Mcf/day and from Teslimköy-2 exceeded 150 Mcf/day, but were not able to be stabilized under the existing completion conditions. Gazelle estimates that each zone could produce between 500 and 2000 Mcf/day in a production scenario. Gazelle intends to return to Pehlivanköy-2 in Q2 2026 for an extended, long-term flow test to establish commercial flow rates for these reservoirs.

Preliminary Completion and Flow-Back of Pehlivanköy-2 Completed

May 23, 2025

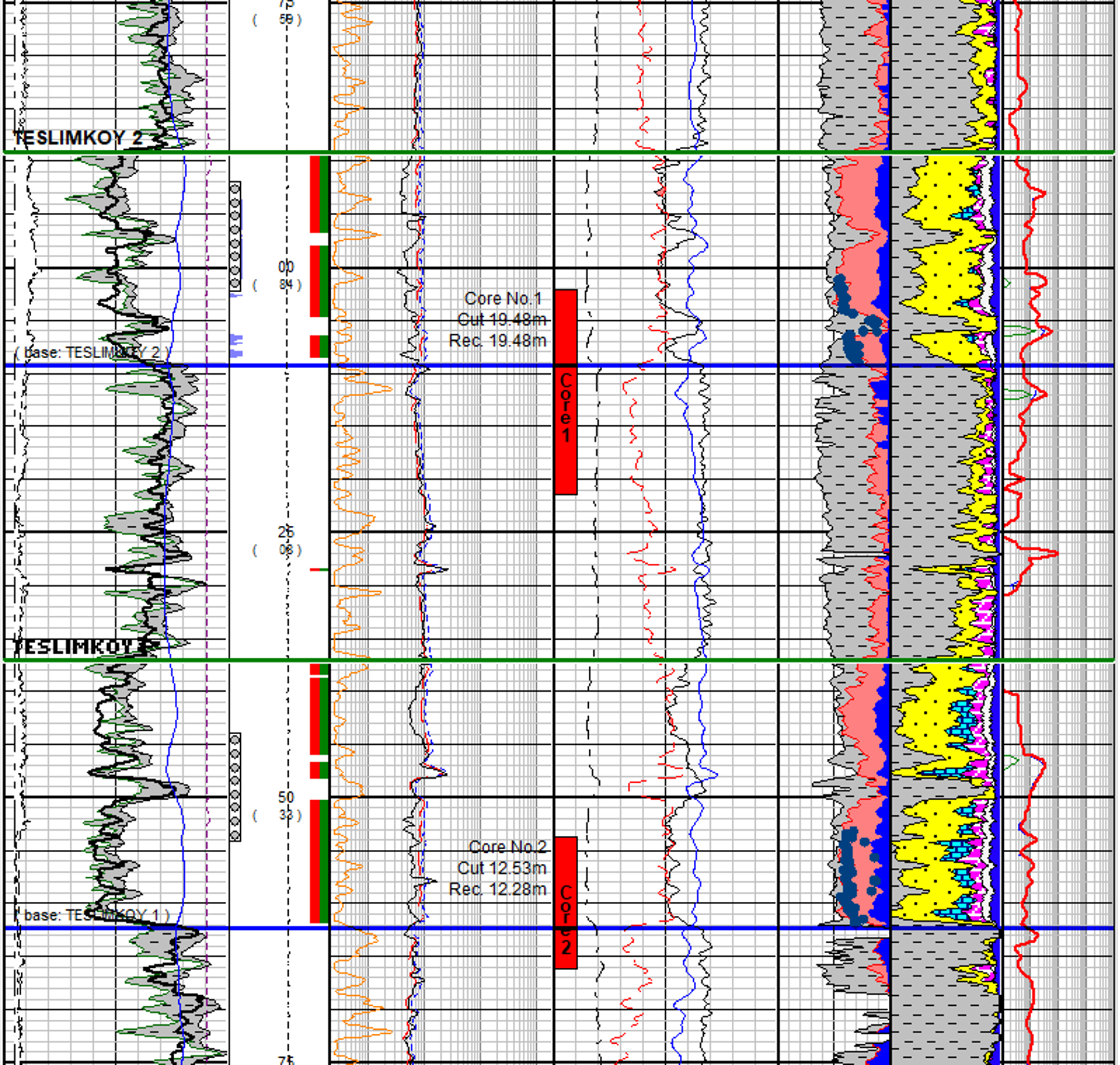

Gazelle Energy Limited is pleased to advise that as of May 23, 2025 the preliminary completion, stimulation and flow-back of the P-2 well has been completed. The primary target Teslimköy-1 and Teslimköy-2 intervals were successfully hydraulically stimulated, and both zones allowed to flow back. Continuous slugging of gas along with frac fluid was observed for the duration of the flow-back period from both zones.

The conventional uphole UM-1 and UM-2 intervals were subsequently perforated on wireline, before running the final completion, which will allow for flow-testing of each reservoir individually. All vendors were then released. GEL is in the process of securing coiled-tubing, nitrogen and slickline services from Romania in order to aid in establishing stabilized flow rates from each zone. The current expectation is a resumption of field operations at the beginning of August.

Completion and Testing Preparation of Pehlivanköy-2

March 3, 2025

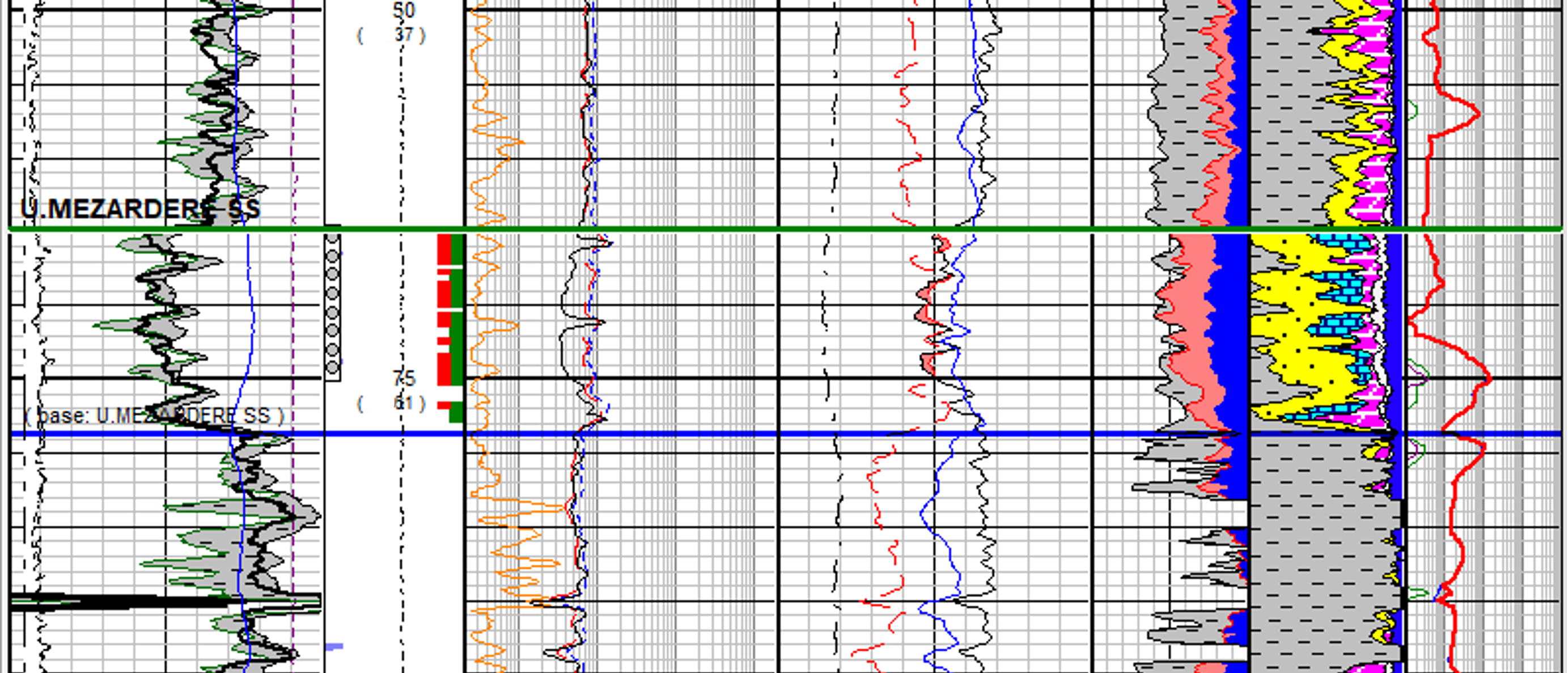

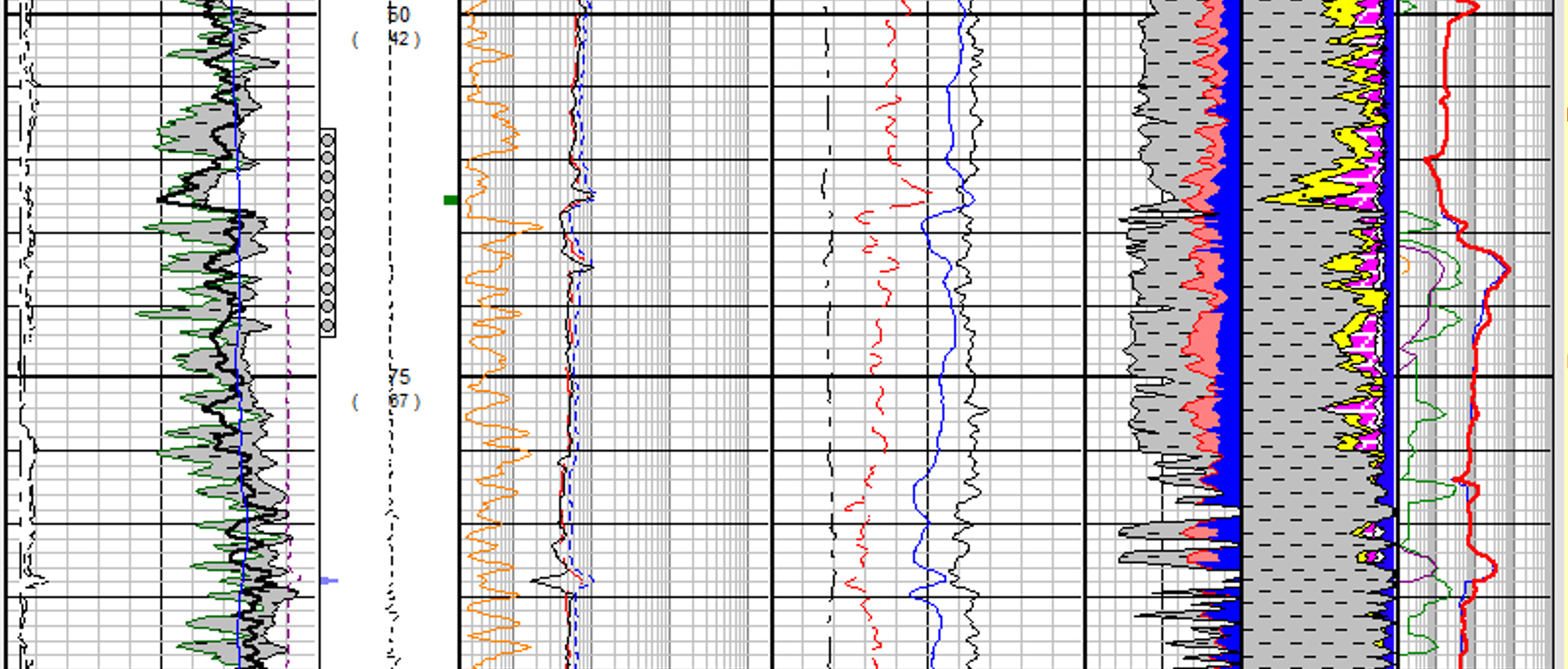

Gazelle Energy Limited has completed preparations for the Completion and Testing of its Pehlivanköy-2 appraisal well and all required service providers have been contracted and equipment procured. Field operations are expected to commence before the end of March 2025. The final design of the program includes fracs in the two primary target Teslimköy-1 and Teslimköy-2 intervals, as well as conventional testing of two, shallower prospective gas intervals encountered in the Upper Mezerdere. Management estimates in excess of 50m of net pay across the intervals to be tested.

Strategic Investment Announcement

October 1, 2024

Gazelle Energy Limited is pleased to announce the closing of an investment from GL Group ("GL"), acquiring a 25% equity stake in Gazelle. GL is a privately-owned group of energy companies based in Baku, currently operating five oil fields in Azerbaijan. Gazelle is excited to have GL as a strategic investor and is looking forward to benefiting from GL's deep technical expertise.

P-2 Completion and Testing Update

February 29, 2024

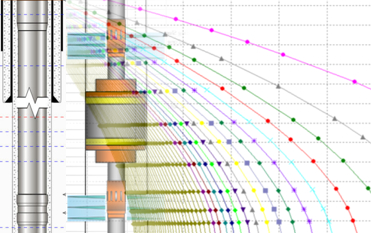

Planning for the Completion and Testing of Gazelle Energy Limited’s Pehlivanköy-2 appraisal well is at an advanced stage, with timing of field operations contingent on equipment availability from the preferred service provider. Results of the ongoing core analysis program are being incorporated into the stimulation design as they are received. The latest iteration of the design and simulated test results lead to an expectation of robust post-frac flow rates from the primary target Teslimköy-1 and Teslimköy-2 intervals. Planning of an expanded completion program to fully assess all five prospective gas intervals encountered while drilling continues. Procurement of the necessary long lead items is underway.

Gazelle Energy Limited Suspends P-2 Well for Completion and Testing

July 24, 2023

Gazelle Energy Limited’s Pehlivanköy-2 (P-2) appraisal well has been suspended for completion and testing, after reaching a total depth of 3,045m Measured Depth (MD) in Metamorphic Basement. The well was drilled in 28 days from spud to rig-release, for a final estimated cost of $2.9MM USD against an AFE cost of $3.15MM USD.

A comprehensive suite of open-hole wireline logs were acquired by Weatherford.

7" production casing was run and cemented on June 30. The initial P-2 well results of the reservoirs discovered in the offsetting P-1 well are very encouraging. The Company will design and undertake a multi-zone completion and testing program after evaluation of the core and open-hole logs.

Sentor Energy Rig-1 Atmaca was released on July 11, 2023

Gazelle Energy Limited officially spudded the Pehlivanköy-2 well

June 7, 2023

The Pehlivanköy-2 (P-2) appraisal well was officially spudded June 7, 2023 at 18:30 TRT with Sentor Energy’s Rig-1 "Atmaca". The well is targeting the Teslimköy-1 and Teslimköy-2 sands, which were proven to be gas-bearing in the offsetting 1992 well, Pehlivanköy-1. The Formation Evaluation program includes cutting conventional core, and the acquisition of a comprehensive suite of modern wireline logs. The main target reservoirs will be cased and the well deepened to Metamorphic Basement at a projected depth of 3,080m. On reaching Total Depth, the well be suspended for completion and testing, pending incorporation of core analysis results into the stimulation design. It is expected the well will take 38 days to drill from spud to rig-release.

Reserve Evaluation Completed for YE 2022

March 15, 2023

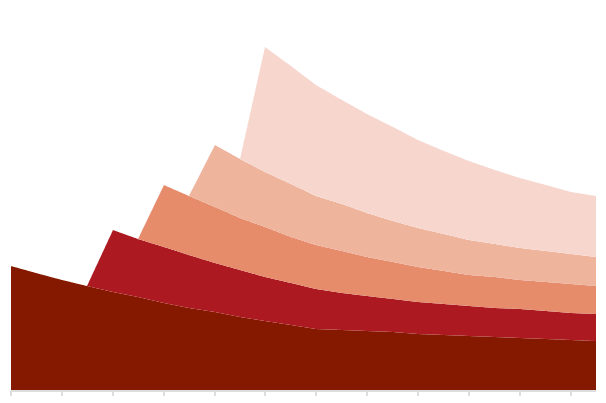

DeGolyer & MacNaughton have completed their Report on the Reserves and Revenue as of December 31, 2022 for the Pehlivanköy Field. Extensive geophysical analysis and interpretation work was performed by Gazelle since the previous report which was confirmed and resulted in materially larger reservoir volumes and the reclassification of a portion of the reserves to Proved Undeveloped. DeGolyer & MacNaughton's reserve assessment attributes 27 Bcf of 1P reserves, 65 Bcf of 2P reserves, and 376 Bcf of 3P reserves GIP to the Pehlivanköy Field.

Closed Financing to Fund Initial Appraisal and Development Program

October 11, 2022

Through a non-brokered private placement, Gazelle has raised $US3.7 million to fund the preliminary phase of their appraisal and development program. The secured financial partners provide the company with the capital to drill the Pehlivanköy-2 appraisal well within the Block F17-b4 licence block, providing new geological and reservoir data (drilling expected in July 2023).

DeGolyer and MacNaughton Completes Evaluation of F17-b4 Licence Block

June 11, 2020

DeGolyer & MacNaughton, has completed a 3rd-party reserve assessment that attributes 47 Bcf of 2P reserves, and 207 Bcf of 3P to the Pehlivanköy Field, in accordance with the Petroleum Resources Management System (PRMS) guidelines. In addition to the Pehlivanköy development project, multiple drill-ready conventional prospects have been identified on the 3D seismic volume. Of those, DeGolyer & MacNaughton estimates Mean Prospective Resource Volumes of 378 Bcf of prospective resources.

Seismic Data Acquisition

July 20, 2019

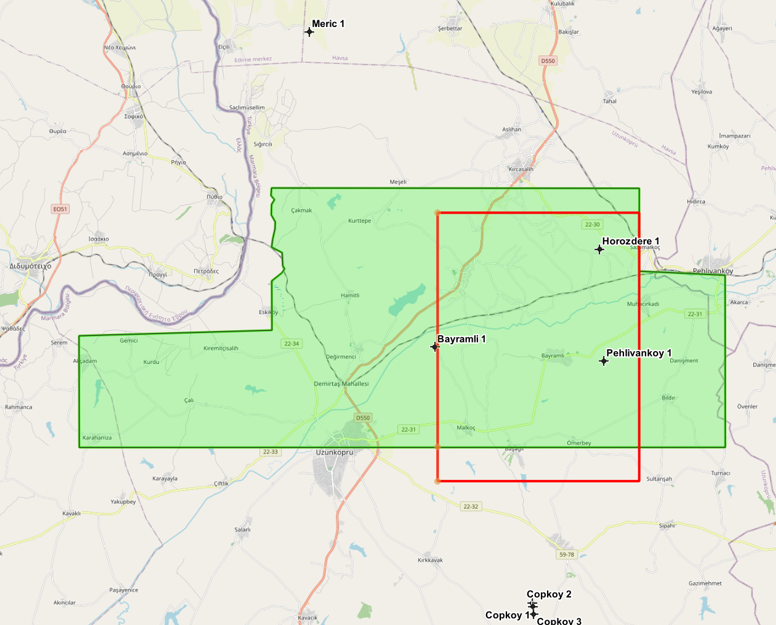

Gazelle Energy Limited has purchased approximately 350km2 of 3D seismic data from TPAO. The Uzunköprü 3D Seismic Survey, completed in 2005, has over 85% coverage of the F17-b4 licence block. This data, along with 2D seismic and well data on hand will help identify additional prospects within the licence block, calculate a full valuation of the property, and ultimately its full development plan.

Block F17-b4 Exploration Licence Awarded

January 26, 2019

Gazelle Energy Limited has been officially awared the exploration licence for Licence Block F17-b4 within the Thrace Basin of Turkey, about 180 km west of Istanbul. The F17-B4 is 145 km2 (35,829 acres) petroleum license with 100% interest. The transaction offers low-risk and low-cost access to a material resource base in a stable political and fiscal environment with potentially very large upside.

Pehlivanköy-1, a legacy well, was drilled in 1992 within the east half of the block encountered 41m of Teslimköy gas pay in two zones and tested at a combined rate of about 400 mcf/d proving a working petroleum system and multi-zone potential reservoirs within the block.