Turkey, Thrace Basin

Block F17-b4

GEL currently operates a single exploration license in the Thrace Basin of Turkey; F17-b4. The block was officially awarded January 26, 2019 and comprises 145km2

GEL currently operates a single exploration license in the Thrace Basin of Turkey; F17-b4. The block was officially awarded January 26, 2019 and comprises 145km2

A legacy well penetration proved a working petroleum system, and the presence of gas. Pehlivanköy-1 was drilled by TPAO in 1992. The well intersected two gas-bearing Teslimköy Member sandstones; 25m and 16m thick, respectively. The sands tested gas at non-commercial rates. However, the prevailing drilling and completion techniques employed at the time are now deemed to have been sub-optimal. Gazelle's team is putting together a drilling program to re-enter the gas-bearing zones, providing for a short timeline to production and cash flow.

Sections

Pehlivanköy-1

The license contains the Pehlivanköy natural gas discovery, originally drilled in 1992 has been reevaluated and assigned 27 Bcf of 1P, 65 Bcf of 2P and 376 Bcf of 3P reserves in a market with robust gas pricing.

Pehlivanköy-2

Pehlivanköy-2 was spudded on June 6th, 2023, and drilled in 28 days to a depth of 3,045m (MD). The initial well results of the reservoirs discovered in the offsetting P-1 well are very encouraging. In addition to the two targeted Teslimköy zones discovered in P-1, three other prospective gas intervals were encountered during drilling. Management estimates are of a total of 50 meters of net pay across the various zones.

The Company designed a multi-zone completion and testing program, based on the evaluation of the core and open-hole logs that were acquired by Weatherford. This program commenced in March 2025.

Both primary target reservoirs, Teslimköy-1 and Teslimköy-2, were hydraulically fracture-stimulated by Schlumberger. All indications were consistent with the frac jobs being pumped successfully, and almost exactly as modelled. Both Teslimköy reservoirs were allowed to flow back for several days, resulting in recovery of approximately 50% of load fluid. Continuous slugging of gas along with frac fluid was observed at surface throughout the flow-back period.

The well was killed and the uphole UM-1 and UM-2 reservoirs were then perforated conventionally on wireline, before running the final completion, designed to allow for zone-selective testing. In order to provide optimal conditions to establish stabilized flow rates, it was determined the best course of action would be to come back with coiled-tubing and nitrogen. Consequently, all vendors were released and Management is in the process of sourcing the necessary coiled-tubing, nitrogen and slickline services out of Romania. All indications are testing operations will resume at the beginning of August.

Thrace Basin Geology

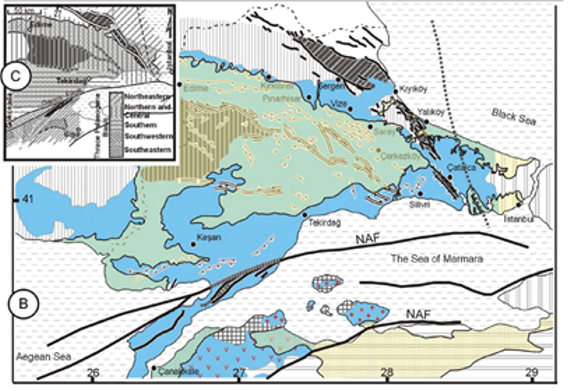

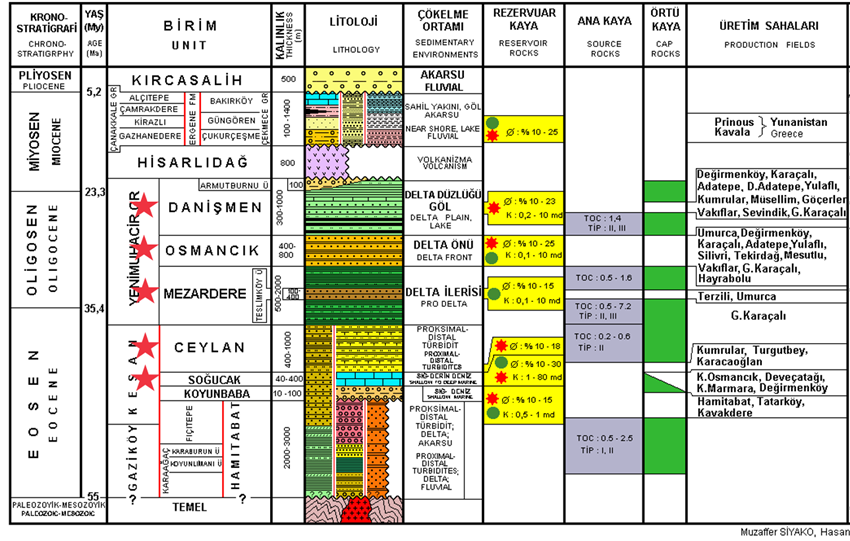

The Thrace Basin is predominantly a gas basin, comprising up to 9000m of Eocene to Miocene marine and terrestrial clastic sediment. The basin formed in response to dextral strike-slip motion along the North Anatolian Fault system, which forms its southern boundary. Initial deposition occurred during the final stages of Palaeogene transtension. Post late Oligocene, the basin continued to evolve in an intermontane compressional tectonic setting. Cenozoic basin fill divided by a middle to late Miocene unconformity, was deposited in a variety of environments. Deep-water marine, pro-delta and fluvial shales provide the source material. Reservoirs are found in turbidite basin-floor fans and channels, deltaic and fluvial sandstones. The Cenozoic sedimentary package overlies Paleozoic to Mesozoic metamorphic basement.

Tectonic setting of the Thrace Basin (Elmas, 2011).

Stratigraphy and Petroleum System Elements of the Thrace Basin (After Siyako & Huvaz, 2007).

Pehlivanköy Gas Discovery

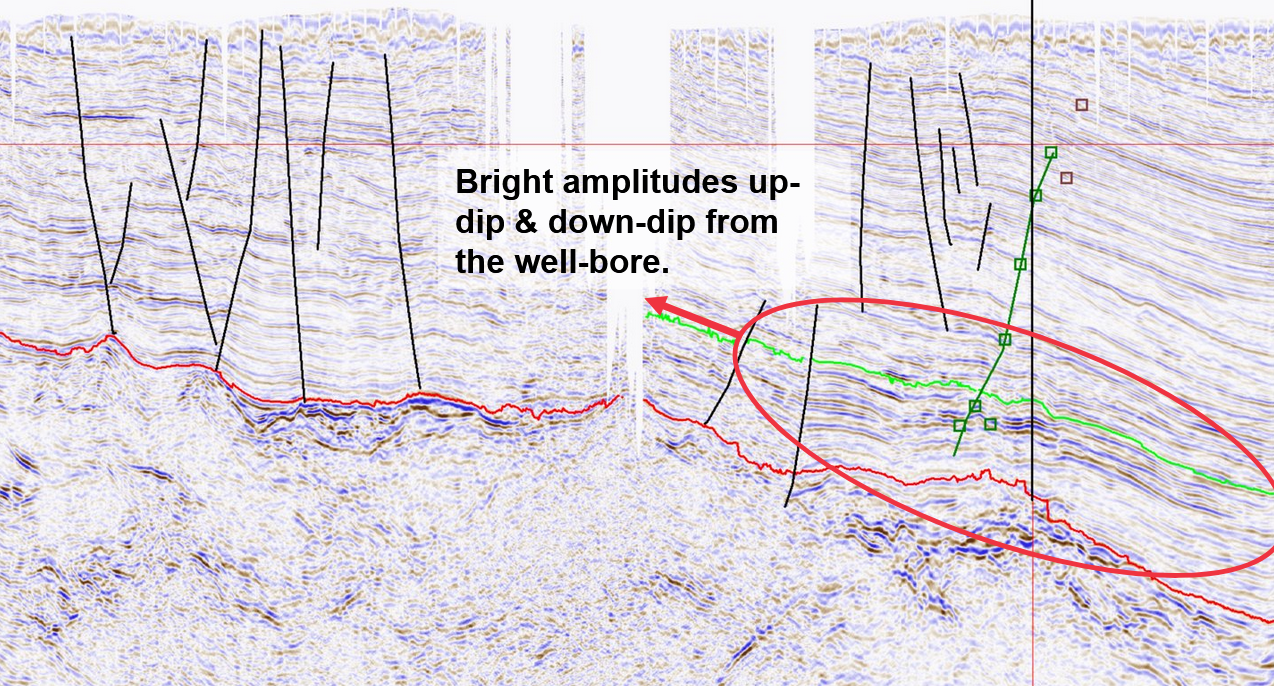

In late 2019 GEL acquired 325km2 of existing 3D seismic data, covering ~90% of block F17-b4. The data has been processed and in addition to the existing conventional discovery, we anticipate development of a drillable prospect inventory with potentially meaningful upside, comprising multiple exploration plays, both conventional and unconventional.

The amplitude signature associated with the conventional sand reservoirs discovered by Pehlivanköy-1 is readily discernible. In December 2022, our reserve auditor, Degolyer & MacNaughton (D&M), assessed the volume of gas associated with the discovery as 27 Bcf GIP at 1P level of confidence, 65 at 2P, 376 Bcf at a 3P.

The opportunity offers low-risk and low-cost access to a material resource base in a stable political and fiscal environment with large upside potential.

The term for an exploration license is five years until January 26, 2026. In case of discovery, a production lease is granted for 20 years, which may be extended twice for periods not exceeding 10 years at a time.

Figures showing cross-section through Pehlivanköy-1 wellbore as well as a total area of 25 m sand alone = 2123 ha (21.23 sq km) within the development area.

Fiscal Regime and Market

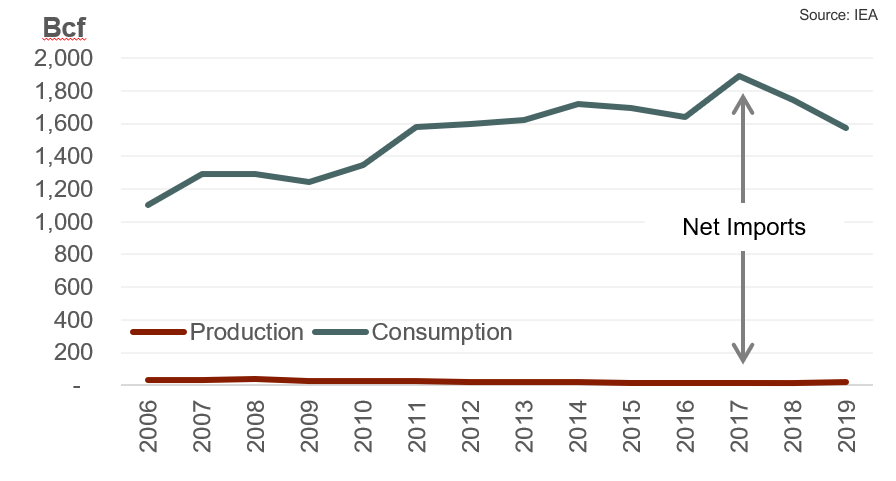

Turkish gas prices and fiscal terms are excellent, and globally competitive. Turkey itself produces less than 1% of its own natural gas consumption – a local market. Additionally, the F17-b4 block has several potential tie-in points to the Turkish domestic grid (approx. 25 km) and multiple export lines to Europe.

- November 2024 Gas Price = US $9.71/Mcf

- Royalty = 12.5%

- Corporate Tax Rate = 25%

Gas Pricing

Gas price in Turkish Lira is adjusted regularly to track price of imported gas, primarily from Russia, and offset devaluation of the Turkish Lira.

BOTAS, the state-owned pipelines and trading company in Turkey currently controls approximately 80% share of Turkey’s natural gas imports, and is expected to be the main potential purchasers of any new domestic natural gas production. BOTAS' pricing structure effectively sets the domestic market due to its dominant position.

Development Program

Drilling : Drilling will be performed in two phases. Phase 1 will consist of two appraisal wells. Phase 2 will be designed and executed based on the analysis of geological data obtained from the Phase 1 and subsequent wells. Phase 2 will consist of 7 to 90 wells for the Reserve scenarios (1P, 2P, and 3P). A separate drilling program will be planned to explore the prospective resources.

Production: The produced gas will be sold through the national grid, and the condensate will be sold locally. The production will be managed with objectives of output optimization and cost control, with all parameters continuously benchmarked against those of other companies operating in the area.

Infrastructure: A 24-km pipeline will be built to connect the well site to the national gas pipeline grid. A gas processing plant will be built for separation of condensate and dehydration of the gas if the gas analysis warrants recovery of condensate.